Hipoteca Digital Introduction

Agregátor obsahu

We are in a moment of tremendous change for consumers and banks. Meanwhile, the number of mortgage loans has increased exponentially.

75% of consumers say they would prefer applying for loans through a digital process in the next three years.

Move forward with your clients’ needs and market trends with Digital Mortgage from NEORIS:

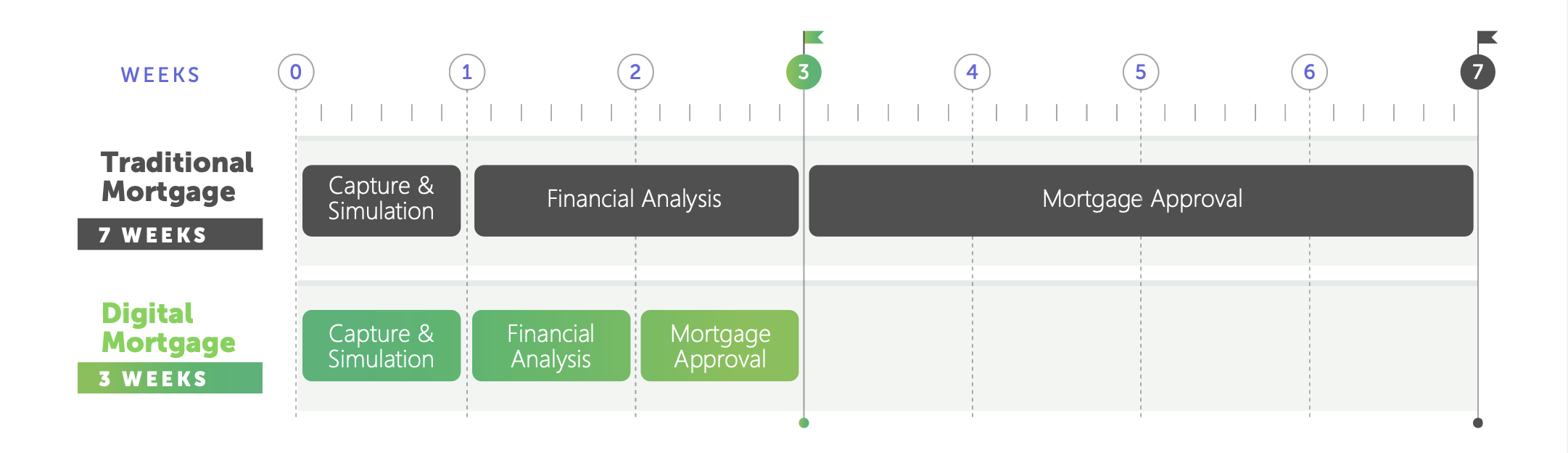

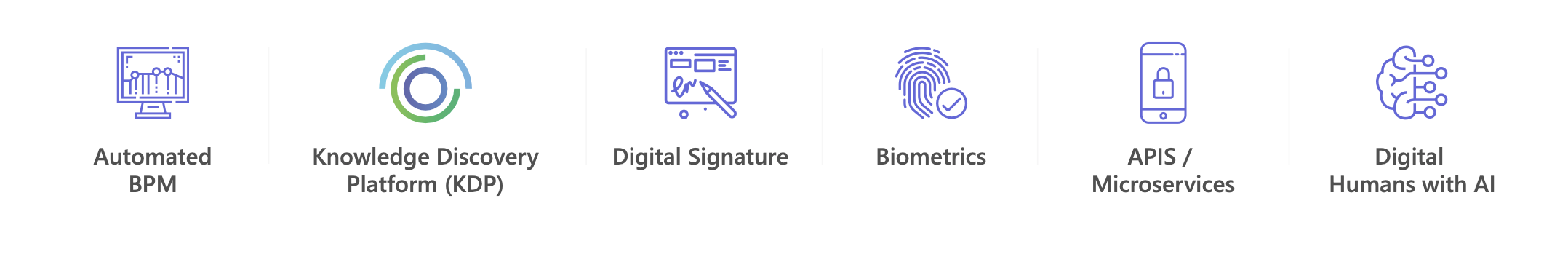

Thanks to the combination of the most advanced technologies, we digitize the mortgage application process, letting your organization be faster and more efficient.

Benefits for your clients

- Better user experience

- 100% Digital experience

- Reduced contracting time

- Fluid, friction free process

- Acoompanied and well informed client

- Customized offer

- 24/7 Customer Service through Digital Humans

Benefits for your Managers

- Reduced back-officecosts (KDP)

- Automated process (BPM automated)

- Complete Tracking of assigned files

- Automatic Reporting of KPIs

- Manager Portal with visibility at all times

- Broker Platform user mode for sharing major captured lead documents

Build trust and loyalty with your clients during one of the most important decisions in their lives.